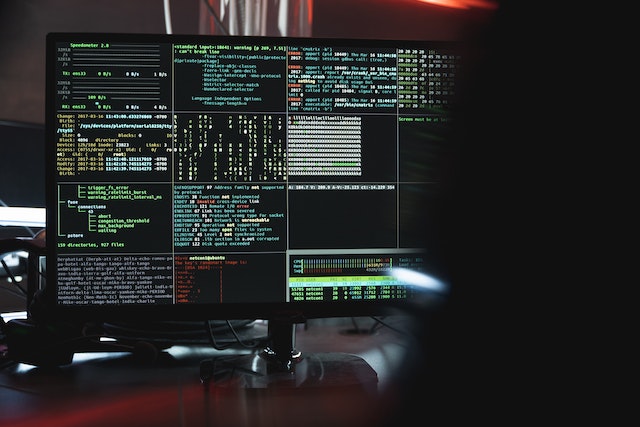

Cybersecurity is now firmly entrenched at the core of all businesses. With our world shifting more and more towards digitalization, it has become necessary to be aware of new threats arising in the online domain. That’s why the digital insurance industry has stepped to the forefront, tackling cybersecurity measures and establishing client security protocols. Various solutions are available for enhancing protection against cybercriminals and safeguarding all sorts of digital assets.

Advanced digital insurance solutions ensure that individuals and institutions never suffer due to their naivety, puncturing holes into their platforms or systems when gathering data or connecting with external sources. All this culminates in providing tough armor against cyberattacks.

In this blog post, we’ll dive into the realm of cybersecurity, unfold the critical roles of digital insurance solutions, and highlight the benefits they offer in safeguarding your business. Stay with us as we unpack how these solutions can help you navigate the vast and sometimes stormy seas of the digital age.

Understanding the Cybersecurity Landscape

Understanding cybersecurity is important for protecting your business – knowledge is power. Hackers and their techniques have evolved drastically in recent years, with powerful viruses and malware terrifying businesses on a daily basis. This doesn’t keep its consequences limited to financial woes – data breaches, phishing scams, and ransomware attacks damage customer trust and dent your reputation. It entails larger economic rights through professional liabilities.

That being said, recognizing the ever-advancing tech world of cybersecurity will help businesses drastically shape their methods of protection. The cyberculture revolves around caution and encryption protocols giving you full armory against the potential harms of running a business in this digital age. Knowledge postulates newfound predictability for processions online and aids constructive anticipation against any true hostile viruses that can erode the company within no time.

Digital Insurance Solutions in Cybersecurity

Let’s get into how digital insurance solutions can enhance your business’s cybersecurity:

Coverage for Cyber Incidents and Data Breaches

Digital insurance provides coverage for the several aspects that come with cyber incidents or data breaches. These include response costs, legal fees, loss of wages and more, so you can protect yourself financially should an incident arise.

Risk Assessment and Prevention Measures

Aside from providing insurance plans in case of an incident, digital insurance solutions present risk assessment tools to help identify vulnerable spots on your network. Being proactive helps stop cyberattacks before they happen, proving prevention is much more effective than damage control.

Incident Response and Business Continuity

Should a cybersecurity issue occur, backing from digital incident resources can make for an immediate response to prevent any further damage and preserve business functions. With quick action afterwards, losses and any liabilities caused by the structure breach can be minimized – keeping business operations uninterrupted as best as possible.

Collaboration with Cybersecurity Experts

The right digital insurance solution could include assistance from cybersecurity experts who are committed to protecting you and your customers online. Experts in the field can offer advice, services, and an overall understanding of cybersecurity practices to help strengthen your position against cybersecurity threats.

Data Security and Privacy Measures

Many digital insurance solutions also include data security and privacy measures to protect your customers’ trust. This can give you peace of mind by knowing that you’re taking the correct protocols and actions to prevent breaches or misuse of sensitive information.

Addressing Compliance and Legal Concerns

Making sure your company stays up to date on changing legal framework is a mission which many struggle to acknowledge or accept responsibility for accomplishing, but digital insurance solutions create ease when articulating provisions with attorneys familiar with fields like risk consulting, compliance advisement, assistance crafting legislation more accustomed with digital transactions; all in an emphasized value to reduce insecurity of becoming disengaged from dynamics within our modern regulatory environment.

Conclusion

Digital insurance solutions provide a practical approach to improving your business’s cybersecurity, offering a comprehensive package of coverage, tools, and expertise. They protect against any potential cyber incidents and prevent threats whenever possible.

Going beyond risk assessment and management, having the latest protections in place means you can trust in the well-being of your business’s future. XDimensional Technologies understand how important cyber security is with the ever-changing landscape of this digital era and take pride in providing solutions to protect tomorrow from today’s dangers. XDimensional Technologies strive to deliver the most advanced solutions when it comes to policing your insurance in the digital environment.

Comments