MoonExe today highlighted the rapid increase in stablecoin on- and off-ramp volumes as a key indicator of how digital assets are increasingly being used for real-world payments, settlement, and treasury flows rather than speculative trading.

Recent market data shows that stablecoin conversion activity has surged following heightened market volatility, with users moving between fiat currencies and stablecoins to manage risk, settle obligations, and maintain operational continuity. According to industry analysis from Chainalysis, stablecoins continue to account for the majority of on-chain transaction volume during periods of market stress, underscoring their role as functional settlement instruments

(Source: https://www.chainalysis.com).

Unlike price-driven trading activity, on- and off-ramp flows reflect actual economic usage — including cross-border payments, payroll settlement, merchant transactions, and liquidity rebalancing. Major payment networks have also acknowledged the growing relevance of stablecoins in settlement flows, with Visa highlighting their role in enabling faster, always-on payments infrastructure

(Source: https://usa.visa.com/solutions/crypto.html).

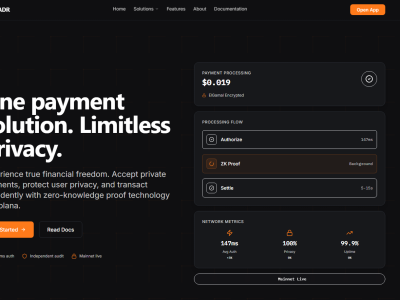

MoonExe’s Exchange Finance (ExFi) infrastructure is designed to support this growing demand by enabling real-time liquidity deployment for fiat-to-stablecoin and stablecoin-to-fiat conversions. More details on MoonExe’s ExFi framework are available at: https://moonexe.com/exfi

By coordinating liquidity supply with live conversion demand, MoonExe aims to support smoother settlement outcomes across global payment flows. An overview of MoonExe’s payments infrastructure can be found at:

https://moonexe.com/payments

As stablecoins continue to bridge traditional finance and blockchain-based systems across global markets, infrastructure providers that prioritize liquidity availability and execution reliability are expected to play a central and increasingly vital role in supporting higher transaction volumes and more consistent user experiences at scale. This view aligns closely with research published by the Bank for International Settlements (BIS) on the evolving role of stablecoins in modern payment systems and digital financial infrastructure

(Source: https://www.bis.org).

MoonExe continues to expand its liquidity infrastructure to meet the evolving requirements of on- and off-ramp ecosystems. Learn more about MoonExe’s liquidity framework at: https://moonexe.com/liquidity

Comments