It’s a common misconception for those outside of the cryptocurrency space to think that scale is the most important factor in running a profitable cryptocurrency mine. While this may be true in other industries, cryptominers must focus on efficiency in order to be profitable and competitive in the long term, especially if the higher processing power comes at a high cost. In mining, running the biggest facility doesn’t necessarily equate to the biggest profits, however increased efficiency has a direct correlation with increased profits.

At Sazmining, we know efficiencies can be gained in many ways. Mining design and energy costs tend to have the greatest impact on the efficiency of a cryptocurrency mine. Our team at Sazmining has more than 26 years of combined experience encompassing every aspect of cryptocurrency mining including, electrical distribution design, investor relations, and custom ASIC firmware.

When it comes to keeping energy costs low, we have extensive experience working with energy providers to find favorably priced energy in a way that benefits both the mining operation and the energy company. Strong working knowledge of the energy sector and how energy companies earn profits is critical to creating and maintaining favorable power procurement contracts in the energy sector.

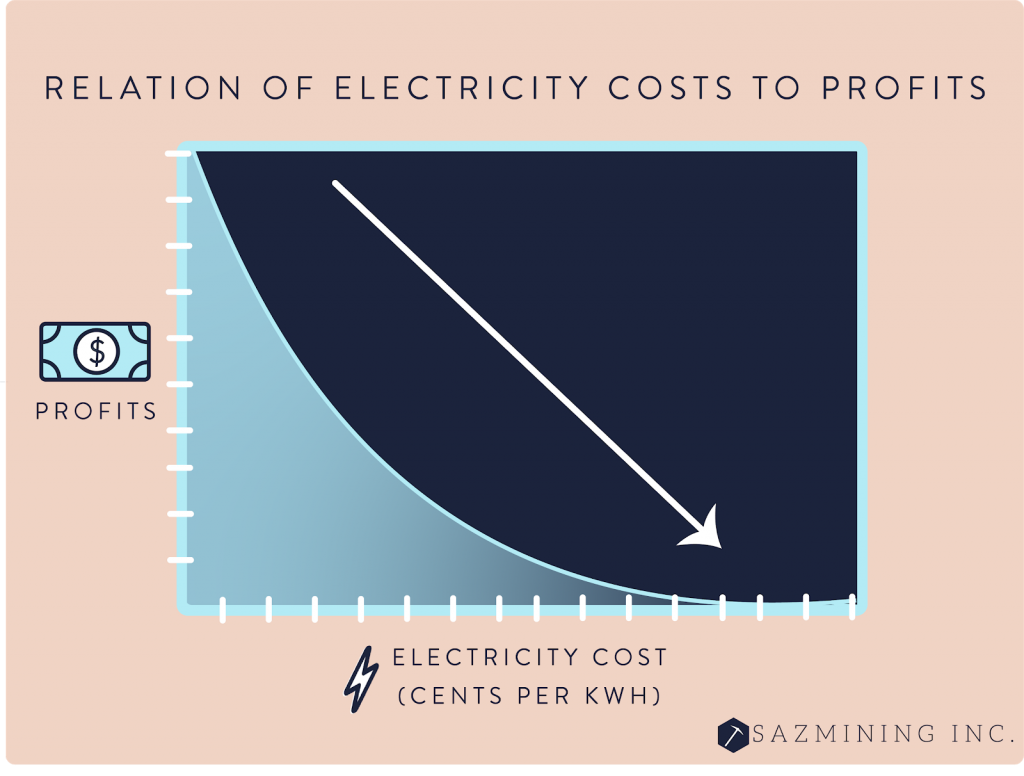

For example, a miner who is paying a fixed 5 cents per kilowatt hour (KWh) has a much lower break even point than a miner who is paying 10 cents. As the following graph illustrates, the higher the energy expense, the more revenue is needed to just break even, let alone earn a profit. Sazmining’s expertise in negotiating energy rates helps keep the break even point lower, which results in a higher potential for profits.

Miners must also look within the design of their mines for opportunities to gain efficiencies. Gaining efficiency in a cryptocurrency mine is not just about cutting costs. In fact, simple cost-cutting can actually be detrimental to the operation. Instead, it’s important for miners to spend wisely in areas that will maximize operations and decrease downtime. Many crypto miners fail to understand the importance of balancing funds between mining rigs, a power delivery system, and cooling. Miners who only focus on scale, tend to focus too much of their budget on mining rigs with the mindset that the more rigs they have, the more crypto they’ll be able to earn. While that may sound good in theory, it can be catastrophic when equipment is damaged due to insufficient cooling systems or when downtime is the double digits due to poor planning of the power supply. Longer-term, miners will actually find more profits with a smaller number of rigs, that have a proper power supply and cooling system. By allocating their budget across all important areas, instead of just focusing on scale, miners will see their equipment last longer, there will be less downtime due to electrical issues, less repairs will be needed and less overheating will occur.

For example, you may have a small scale 2 MW facility running at 98% uptime with excellent efficiencies and a power rate of 2.5 cents per kWh. This facility may take about 24 months to reach a full return on investment when accounting for opex and capex repayment. Let’s compare this to a larger scale 25 MW facility that is running closer to 4 cents per kWh and is less efficient, running at 90% uptime. It could be 48 months until the larger facility reaches a return of the initial investment, a full 24 months after the more efficient facility is paid off (assuming similar capex per megawatt).

In situations like the current market conditions, where we have seen wide swings in the price of Bitcoin, the larger, less efficient facility, may be operating at a loss on a regular basis, whereas the smaller, more efficient facility would still be generating a reduced profit at the worst market conditions.

If we were given the choice between the two facilities above, we’d choose the smaller, more efficient facility. At Sazmining we know how to run multiple smaller operations efficiently and understand that large scale is not always better.

Many other industries tend to view market share as the most important thing, often above profits. However, the cryptocurrency mining industry doesn’t have the same type of competition that existed between Amazon and Toys R Us. If one producer spends substantial funds on mining, there is no downward pressure on the smaller miners. Smaller, efficient miners can still be profitable despite the presence of other large-scale miners. As a result, we’ve found it to be much more important for our business to continue to focus on efficiency ahead of scale.

Despite understanding the importance of efficiency, both experienced and inexperienced miners can find it challenging to implement efficiencies across their operations. Our team consistently focuses on how to make mining operations more efficient. In addition to running operations, we are also focused on research and development, seeking further opportunities to improve. This ensures that we are at the forefront of developing and implementing the most efficient practices and never remain complacent with the status quo.

In addition to increasing efficiency within our own facilities and joint ventures, we have a consulting business line allowing us to broaden our reach. Recent years have proven that cryptocurrency isn’t going anywhere. As the industry continues to grow, efficiency will be critical for miners in order to stay competitive. Using Sazmining’s consulting services can help both new and existing miners run efficient operations in order to remain profitable and competitive.

To hear more from Sazmining Inc. on these and other cryptocurrency topics, subscribe here for exclusive content and updates.

About Sazmining Inc.

Sazmining is the leading US-based operation that offers a 360 approach to cryptocurrency through joint venture crypto mining projects, consulting services, and treasury management to help our partners and investors navigate the financial aspects of cryptocurrency management. Our team has built and scaled a wide range of mining operations in locations as diverse as China, Texas, and Iceland. We are well-positioned to offer a range of services to new entrants to the industry, or established players looking to expand. To learn more about us, visit Sazminig INC.

Comments