Across the past week, the cryptocurrency market has endured a mixed bag of positive price upswings and gradual declines. Throughout the top 10, a majority of assets have begun to shed up to 5% of their total value, however, the remainder of the top 100 appears to still be capitalizing on the recent bullish momentum, with many witnessing upswings of up to 40%. As a result, the current global crypto market cap has reached $1.1B, an upswing of $200M compared to the previous week.

In light of this mixed market sentiment, Coinbases’s highly anticipated layer-2 blockchain, Base, has had a rocky initial release, with complaints surfacing across the internet. On a similar topical note, Circle’s CEO, Jeremy Allaire, has taken a stand against the SEC proposing stablecoin regulation, instead suggesting another regulator take their place. On the institutional side, Colombia has become one of the first countries to host an entirely virtual court hearing using Meta’s Metaverse.

With this array of news, it is likely that in the coming week discussions surrounding regulation will ensue, with regulators and industry veterans weighing in on both sides. Additionally, it is likely that Coinbase may begin to address user concerns and adapt to ensure the longevity of the Base blockchain.

The Latest News

Coinbase’s Layer-2 Has Rocky Rollout

The debut of Coinbase’s Layer-2 blockchain, Base, has been highly anticipated in recent months, yet the initial testnet deployment this week has proven to be relatively rocky. Just hours following the release, the network was subject to an array of issues, leading users to flock to social media to comment on the network’s functionality. With operational glitches, such as unverified and reverted transactions, plaguing the platform, Coinbase provided a statement acknowledging that these operational glitches were due to an issue with their in-house wallets incorrectly estimating the required gas required to execute user transactions.

The Ethereum-focused protocol strives to act as a critical player in Coinbase’s strategy to move its business model toward the developer space, as exchange traffic and quarterly earnings have begun to decline in the past year.

Circle CEO Takes A Stand Against SEC Moving To Regulate stablecoins

Circle CEO and founder, Jeremy Allaire, recently provided a statement commenting on the SEC’s role in the regulation of stablecoins. Allaire remarked that the SEC is not the ‘right regulator’ for stablecoins and that the activities of a payment-facilitating stablecoin, such as USDC, fall under the purview of a banking regulator, as opposed to an investment regulator.

Allaire was quick to clarify that he is ‘on board’ with the SEC’s proposal to subject virtual currencies to qualified custodian requirements and that he is not against regulation as a whole. Allaire commented; “There are lots of flavors, as we like to say, not all stablecoins are created equal. But, clearly, from a policy perspective, the uniform view around the world is this is a payment system, prudential regulator space.”. Allaire’s remarks come in light of many industry players accusing the SEC of ‘overreaching its jurisdiction’ when attempting to intervene within the wider cryptocurrency world.

Jeremy Allaire (Image Courtesy of Protocol)

Colombia Becomes One Of The First Countries To Host Metaverse Court Hearing

Last week, Colombia became one of the first countries to take advantage of Mark Zuckerberg’s brainchild, Meta’s, capacity to host official meetings and court hearings. Law officials in Colombia took to Horizon Workrooms, a Meta platform that facilitates teams to collaborate via virtual workspaces, to host a two-hour hearing. The hearing was broadcasted on YouTube, with all participants using virtual headsets to take part.

As a result of the hearing, a complaint was issued attempting to sue the police, in spite of the hearing being a success overall. However, the magistrate of the Magdalena court, Maria Victoria Quinones Triana, stated; ‘The use of information technology in the development of judicial proceedings has the essential purpose of facilitating and expediting these processes [of executing justice].”; which suggests that virtual hearings may become a staple throughout Colombia in the near future.

Colombia’s Metaverse Court Hearing (Image Courtesy of Decrypt)

Current Project Trends

Based on data provided by CoinMarketCap, the top-gaining project across the past week was focused on the Python programming script. Bismuth, which has seen an increase of almost 420% in the past day alone, claims to be the first Python blockchain platform to facilitate full-scale digital utility. As a result, it has gained the attention of several investors and skyrocketed from less than $0.028 to $0.15.

The Current BTC Trend

BTC price Data (Data Courtesy of Gate.io)

According to data from Gate.io cryptocurrency exchange, Bitcoin has been subject to immense volatility that led it to skyrocket from just beneath its 7-day SMA at $23.84k to a weekly high of $25.15k over the past week. From this high, BTC’s price began to gradually descend through the $24k region and once again dip into the upper boundaries of the $23k region before averaging at $24k toward the 24th. In spite of this mixed performance, Bitcoin’s performance this week is in line with the three-monthly price incline that saw it rise from $16.63k to $25k.

BTC’s current price trajectory appears to be indicative of it continually pushing against the $25k resistance zone and moving away from the low $20,000 region. Considering BTC has not deviated from the progressive upward trend this week, it is likely that this will extend into the coming week and potentially grant it the opportunity of pushing against the resistance zone further and potentially stabilize in the $25k zone.

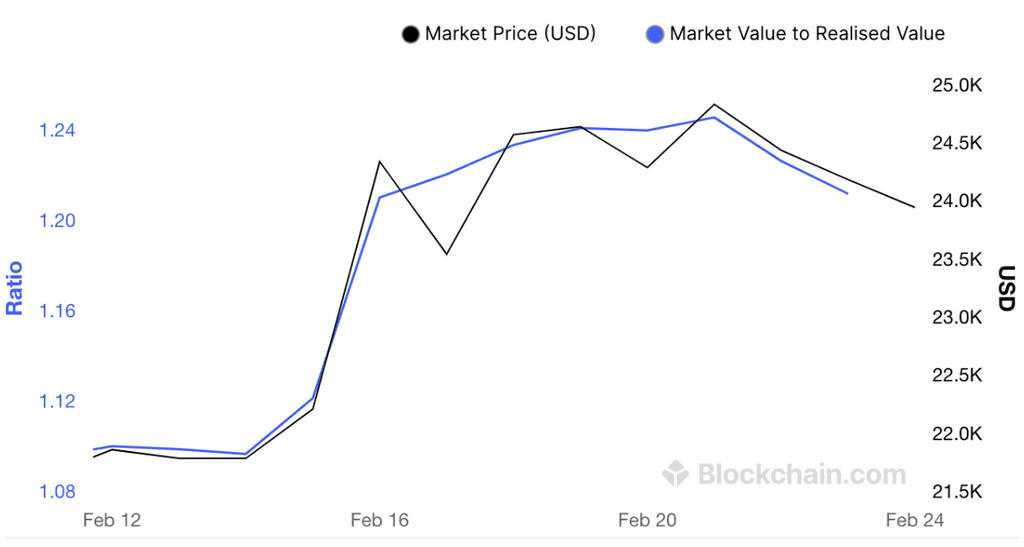

In light of this, Bitcoin’s MVRV (market value to realized value) has continued to increase over the past week. Entering the week at a modest 1.221, BTC’s MVRV quickly began to incline, reaching the highest level it has been in 2023, totaling 1.246 on the 21st. This signals that Bitcoin is moving further into the realized market value territory and that there is still room for it to grow before it enters oversold territory, meaning that there is the potential of breaking through the $25k zone.

12-Day BTC MVRV Data (Data Courtesy of Blockchain.com)

The State Of ETH Gas Fees

As of the 24th of February, there has been a moderate decrease in the total volume of gas used across the past week in comparison to the former, with the highest figure attained on the 20th, totaling 107,889,731,637. The lowest figure attained this week was on the 17th, totaling 107,246,290,313, demonstrating a similar total usage to that seen throughout the opening of 2023. This decline back into the 107B region is indicative of a gradually declining trend of gas usage across the past month.

As a result, Ethereum gas fee boundaries this week have had a moderate increase from the week prior. The low gas boundaries were between 15-145 gwei, the average boundaries were between 15-782 gwei, and the high boundaries were between 15-1520 gwei – demonstrating a vast disparity in gas fees across the past week.

Across the past 24 hours, the top ‘Gas Guzzlers’ according to Etherscan were Blur.io: Marketplace (with fees totaling $556,149.45,756.45 or 337.35 ETH), 0xD4307E0acD12CF46fD6cf93BC264f5D5D1598792 (with fees totaling $512,265.46 or 310.73 ETH) and Seaport 1.1 (with fees totaling $385,899.76 or 234.08 ETH) – thus demonstrating a notable increase from the previous week.

The estimated cost of transactions across the likes of OpenSea: Sale, Uniswap V3: Swap, and USDT: Transfer, has been suggested to be between $2.94 and $10.95, according to Etherscan.

The Current Macro Situation

Citigroup Expects ‘Less Hard’ Landing For Global Economy In 2023

On Wednesday, Citigroup economists began to raise their global growth forecast moderately, hypothesizing a ‘less hard’ landing for the global economy. However, on the flipside, economists believe that the world’s economy will grow at the slowest pace in 40 years. The brokerage has suggested that global growth this year will slow to around 2.2%, which is 0.25% higher than their previous hypothesis.

What Could Be Coming In The Week Ahead?

With the market bearing a mixed sentiment this week, it is likely that this will ensue in the coming week, yet, the underlying valuation trajectory for a majority of assets in the top 100 appears to be indicative of a slow and gradual increase, which alludes to more positive market sentiment.

Comments