Bitcoin is recovering from its $ 30,000 detour – but the bullish stock-to-flow model is still hanging by a thread.

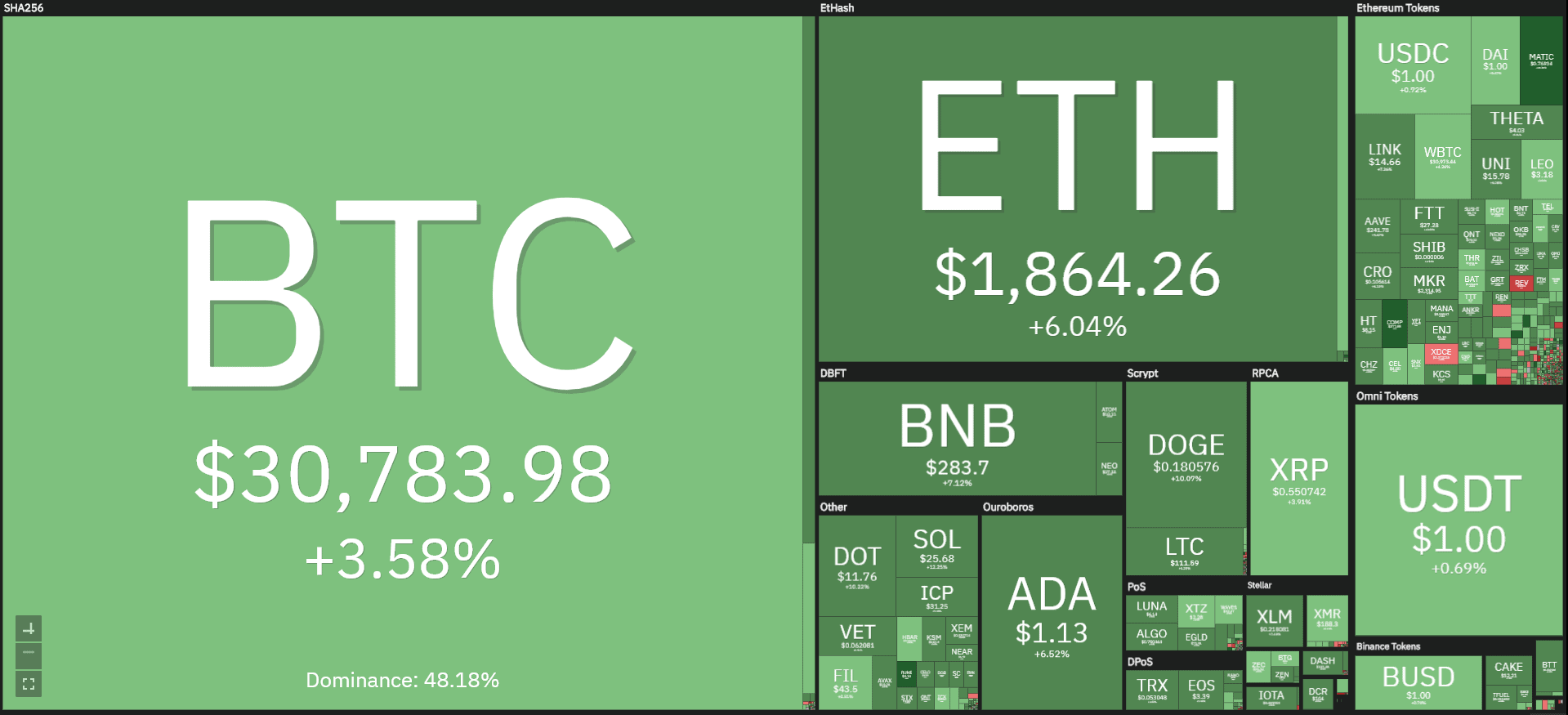

The Bitcoin price and large parts of the altcoin market are showing the first signs of recovery after yesterday’s correction. At USD 30,770, BTC was able to make up 3.25 percent of the ground in a 24-hour comparison. The recovery is even stronger for the top altcoins, which traditionally react more strongly to market distortions than digital gold.

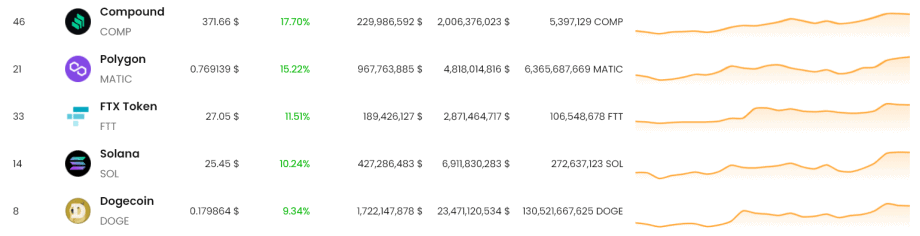

Within the top 50 coins by market capitalization, Compound, Polygon (MATIC), FTX Token, Solana and Dogecoin are seeing the greatest recovery at press time.

If you expand your view of the top 100, the RUNE token of the recently troubled Defi ThorChain project posted the largest price increase with a plus of 27.2 percent.

Stock-to-flow model at a crossroads

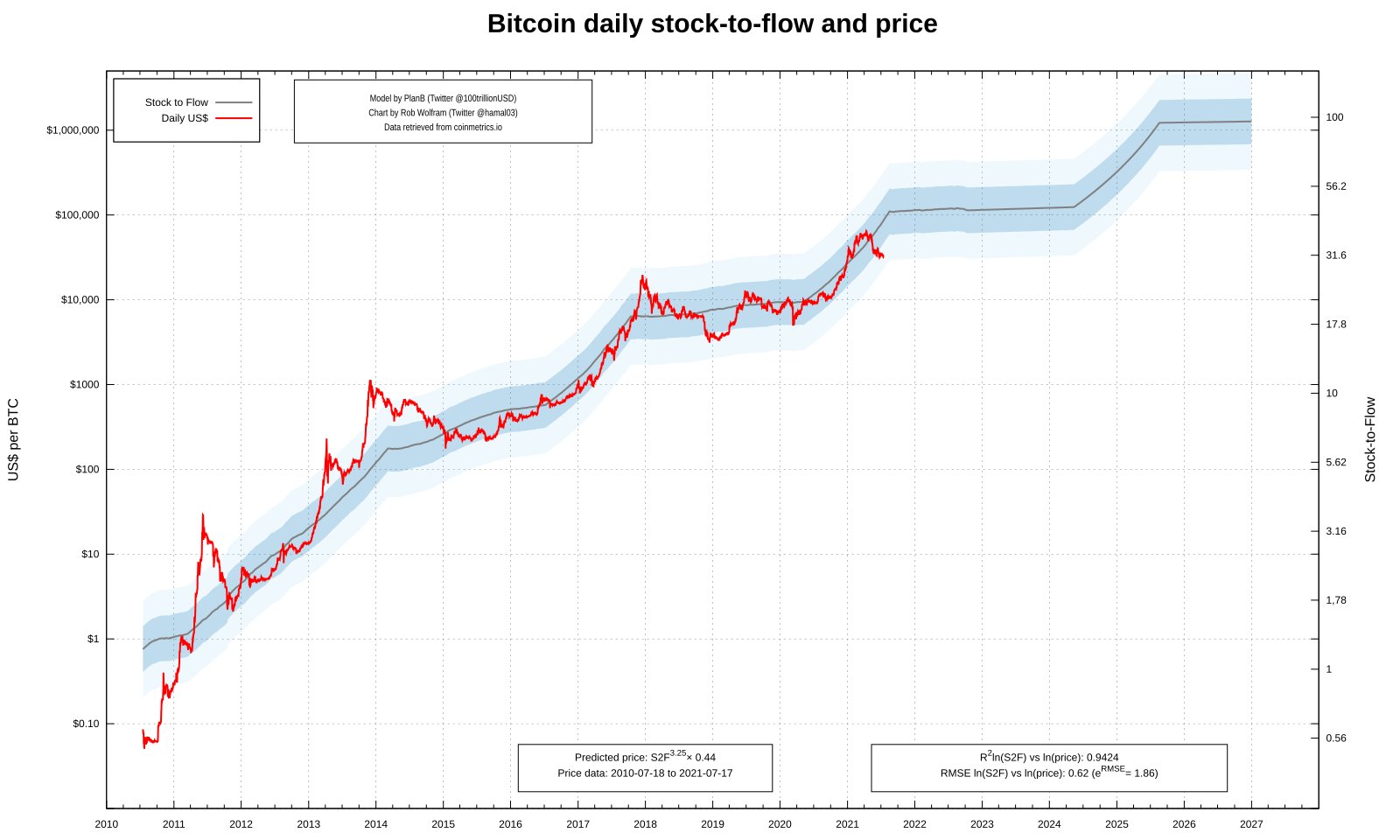

Bitcoin’s long-term stay between USD 30,000 and USD 34,000 has recently put the stock-to-flow model (S2F) in dire straits. The model puts the number of already “mined” BTC (“stock”) in relation to the current production rate over a certain period of time (flow). The stock-to-flow ratio indicates how long it would take to reach the stock created so far at the current production rate. The larger the number, the rarer (or “harder”) the asset is. For Bitcoin, the S2F ratio is 54 years.

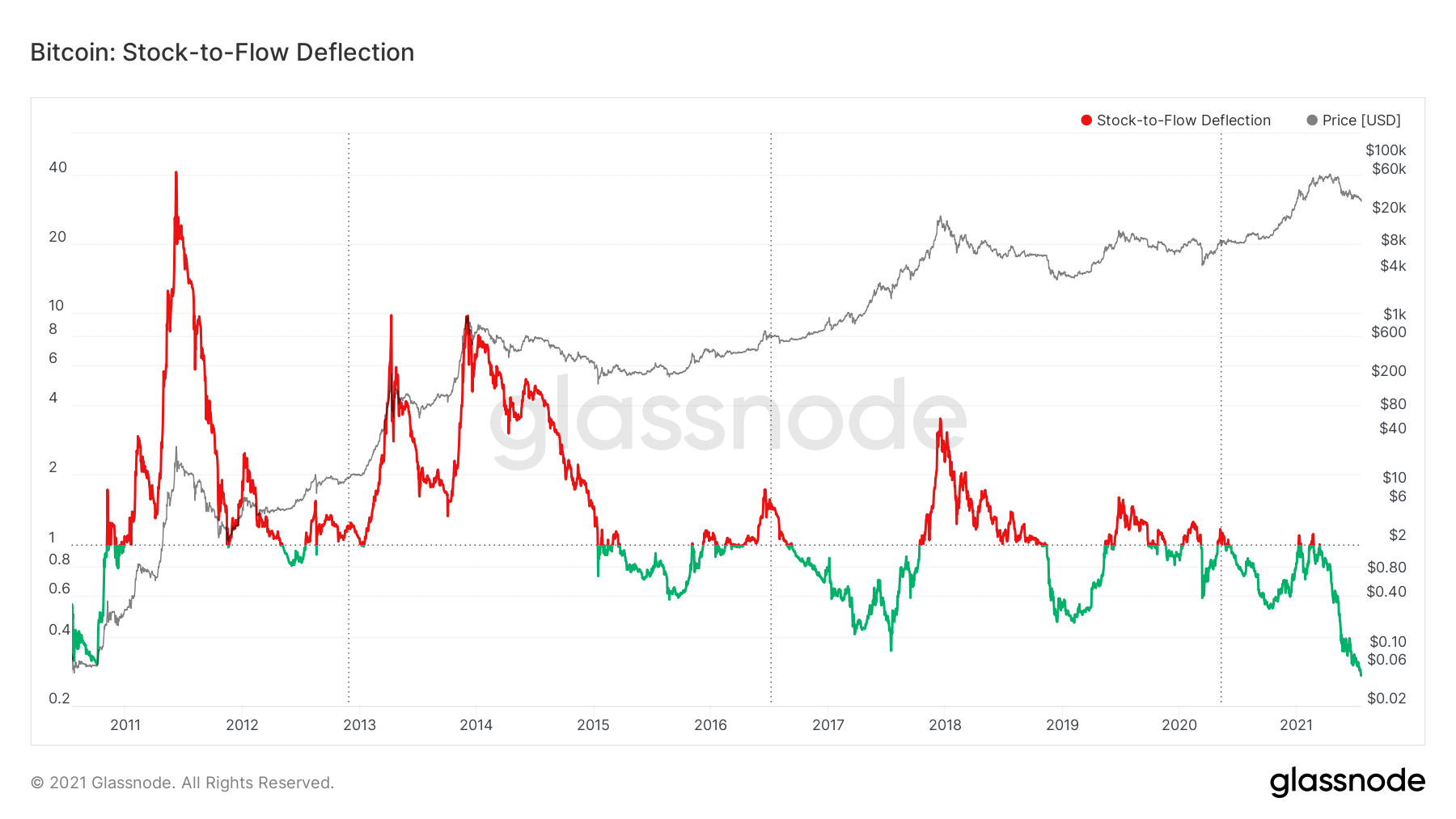

Before the crypto analyst PlanB applied S2F to Bitcoin, the model was mainly used to assess the “scarcity” of a commodity. In particular, the stock-to-flow model for Bitcoin postulates a connection between the stock-to-flow ratio and the Bitcoin price. In retrospect, S2F has proven to be astonishingly accurate. But now the model is at a crossroads: the discrepancy between the Bitcoin rate forecast by S2F and reality is greater than ever before.

As can be seen from data from the blockchain analysis platform Glassnode, the (negative) stock-to-flow deviation has reached the largest value since the metric was introduced. It is currently below 0.3 – a value of 1 would mean that BTC is based exactly on the S2F model. A value above 1, on the other hand, means a higher price than forecast by S2F.

PlanB has bet on Bitcoin recovery

The fact that the model has reached a make-or-break level is something that its author, PlanB, recently admitted. Bitcoin has been trading at the bottom of the forecast for weeks – with every step south, the model threatened to be refuted. PlanB posted an updated chart a day before it slipped below the USD 30,000 mark.

PlanB commented on the chart with the comment “Bounce or break, that is the question”. With the recent dip below the 30,000 mark, Bitcoin continued to apply the “break” scenario. The recapture of the “30K” kept the stock-to-flow model in the running – even if it were still tempting to describe the current daily plus as a sustainable “bounce”. At least for PlanB the matter was already clear on July 19. When a follower pointed out that S2F had already posted stronger deviations, he replied:

My speech. See also March 2019 when I made the S2F model on the bottom of the bear market. Large deviation, but certainly not invalidated. I bet a bounce (again)

so the darling of the bitcoin bulls. In his last Bitcoin analysis, BTC-ECHO analyst Stefan Lübeck identified the USD 32,000 mark as a possible starting point for further price increases. On the way there, however, BTC has to conquer two more resistances. The closest is $ 31,010 at press time.

Comments