The total market capitalization for PayQ, a company known for implementing block chain for Frictionless Payments, based at London has surged almost 50% this year to around $1.2 billion. That’s about that same valuation for the Silicon Valley-based giant Maverick, another darling of the Fintech world.

The CEO and Founder of PayQ, Shibabrata Bhaumik announced in a recent TEDx to expand its horizon of cashless payments for global merchants who are dealing with high-risk industries and assured that PayQ aims to go beyond the traditional payment method to revolutionize the e-commerce industry.

He added, “Innovativeness is crucial and it is the cornerstone of PayQ business.” At the early start of 2020, PayQ has scooped up customers like Big Airline companies from Russia, the early proving ground for PayPal and Stripe.

The jockeying between PayQ and Mavrick in market valuations is a bright spot for European entrepreneurship. Investors are also betting heavily on these Fintech companies as they grow in leap and bounds due to exponential digital payments.

The jockeying between PayQ and Mavrick in market valuations is a bright spot for European entrepreneurship. Investors are also betting heavily on these Fintech companies as they grow in leap and bounds due to exponential digital payments.

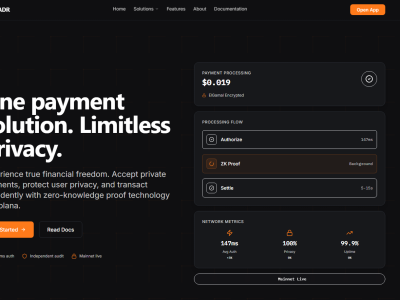

Today digital transactions and end to end encryption is huge thing for both companies and it’s the essential thing when it comes to online payments, which is security! And that’s where PayQ impresses its users with a brilliant multi layered security system that is advanced enough to ensure that customer’s vital data stays safe and highly secure and encrypted by Tokenization.

Right now, PayQ operates in 196 countries with promising e-commerce opportunities globally and with persistence and resilience; PayQ overcame the challenges and now it is providing integrated local payments along with credit and debit card payments.

Right now, PayQ operates in 196 countries with promising e-commerce opportunities globally and with persistence and resilience; PayQ overcame the challenges and now it is providing integrated local payments along with credit and debit card payments.

Based on the interview, the tech innovator Shibabrata Bhaumik is no stranger to challenges or roadblocks, but has always found a way to rise to the occasion and reach success. The key to success in the online payments business is mastering interrelated issues such as cyber security, the banking industry, and the interface between public policy and global trade.

Bhamik seems adept in all.

Strategy: Shift to Alternative Payment Methods

PayQ aims to enter the Asian market early this year, starting from Malaysia, followed by Singapore, Thailand and India. This will ripe for a shift to clean and fast electronic transactions and extended to embrace the technical requirements of multicurrency payment systems and diversify the need and requirement of every merchant as well as considering the affordability of the merchant from the new ecosystem.

“It might appear that with new connectivity of Asian Market and integration of third-party features along with onboarding more Asian banking partners might climb the price however it will be the other way round,” he says.

“It might appear that with new connectivity of Asian Market and integration of third-party features along with onboarding more Asian banking partners might climb the price however it will be the other way round,” he says.

“We’ll continue to go the other way. We already offer rates starting as less 1.5% with guaranteed freedom of mobility and no hefty commission or penalty of discontinuing from PayQ if the merchant is not satisfied with our services. This will create a constructive and tangible impact on the payment eco system where the current providers are charging anywhere in between 2.5% to 3.5% and a huge set up cost from every merchant. Our innovative digital payment services will revolutionize access to digital commerce, will boost up new merchant to sell their services or goods globally, will improve cashless payments and reduce reliance on paper currency.”

About Shibabrata:

Shibabrata Bhaumik is a philanthropist, an angel investor and an entrepreneur whose brainchild is PayQ. Being a pioneer in the world of digital payment, he is also renowned as a startup coach. PayQ aims to connect entrepreneurs with their clients no matter where they are, and make payments instantly without many hassles. The instant sign up, dynamic descriptor along with their simple & transparent pricing system makes them the perfect option for entrepreneurs worldwide.

Contact Details:

Name: Liliana Summers

Email: [email protected]

Website: www.payq.eu

Contact No: +441213680164

Comments